When it comes to your investments we want to help you get more for your money and reach your financial goals. On a one to one basis, our advisers undertake a review of your personal circumstances and help you make investment decisions crucial to your financial needs. Investment plans can vary greatly and as such, our advisers are best placed to match the right plan to your own objectives.

Advantages of using an adviser include:

Our advisers have a wealth of expertise when it comes to realising your objectives and the best methods of achieving them

Using a financial adviser offers you a level of protection in case things don’t go to plan

Advisers are best placed to do a risk assessment to see exactly how much you can afford to invest each month

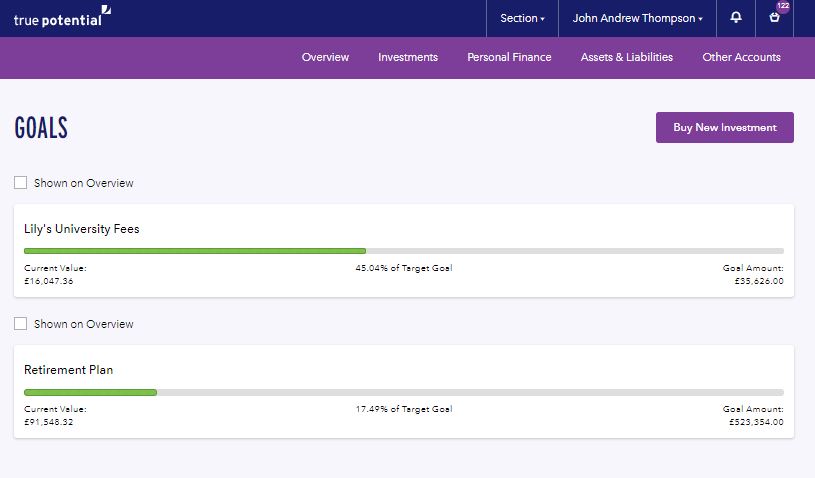

We don’t just specialise in helping your investments grow. We also want to help you achieve your saving targets – quicker! For example, if you are looking to save for your child’s university fees and think you’ll need to save £3,000 a year for 10 years, we want to help invest this wisely for you so you perhaps only need to save £2,000 for 10 years and let the money grow for you.

Many people think investing money can be costly, but this is not the case. We provide a free initial consultation to discuss your goals and objectives before explaining the costs. Our typical charge for advice is 3% of the sum invested. On occasion, and depending on the complexity of the work involved, we may charge more or less than this.

It also doesn’t matter how much or how little you want to invest – our target is to help you reach your financial goals quicker by investing in the right places; whether that’s just a few thousand for a family holiday or a few hundred thousand for your future retirement – our expert advisers can help get you there.

Platform Services

Our generic investment proposition outlines the essential elements a client should consider to maximise successful investing. Our advisers will help you to understand risk vs reward in making investment decisions and how much to invest over what time.

Where to invest

How much to invest

How long to invest

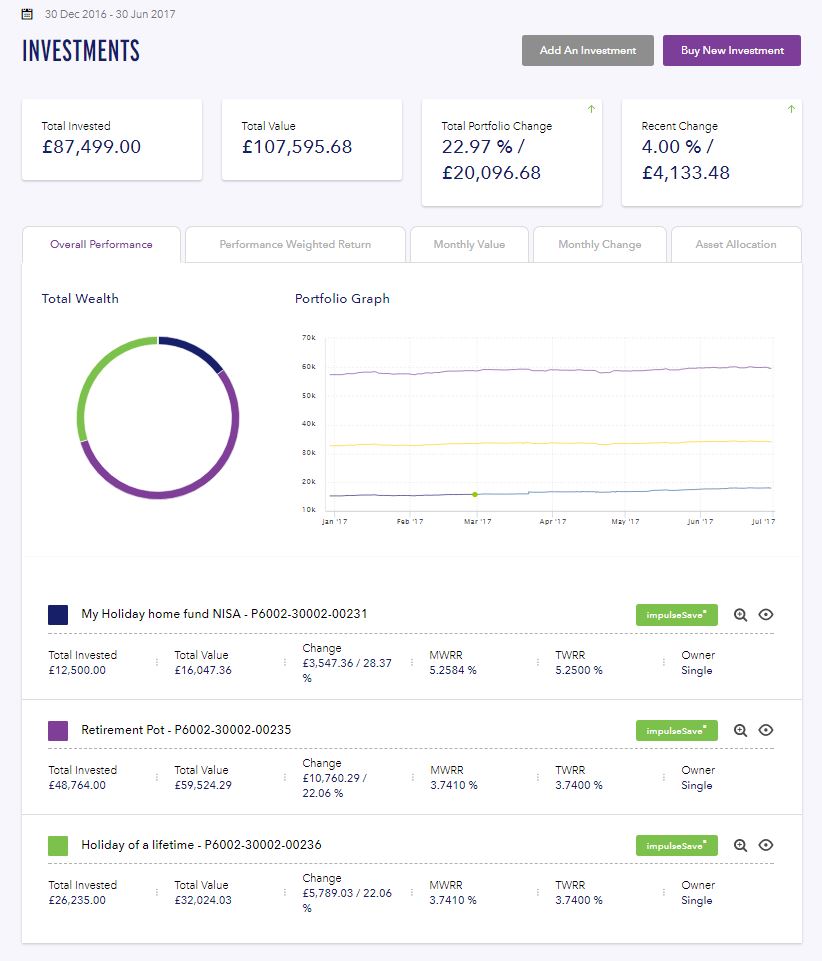

One place to see all your investments

We offer clients an unrestricted broad investment choice of products which include the use of platforms. This will allow all your investments to be accessible in one place. You may even be able to simply log into your management system and get an update on how all your investments are performing.

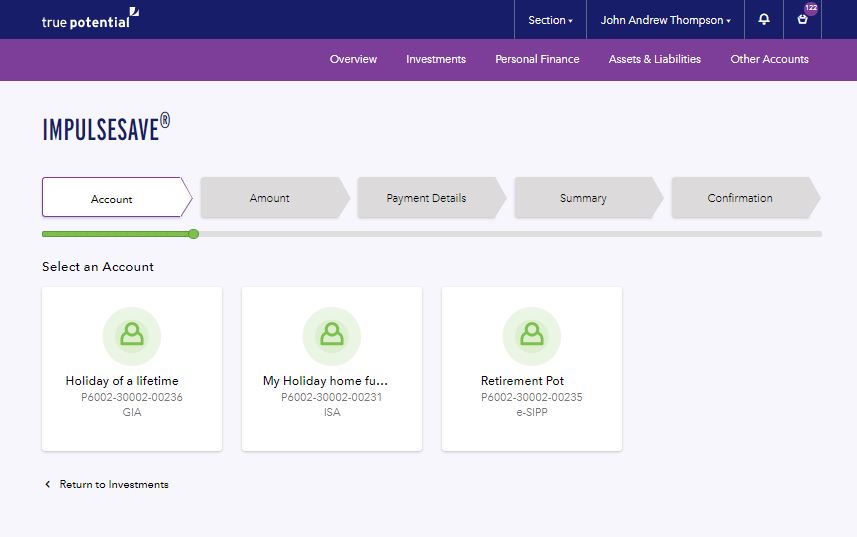

This handy tool allows you to keep an eye on all your investments and how they are performing. It may be possible to keep an eye on the different goals you’ve set up as well as doing an ‘impulse save’, in some circumstances, to top up some of your current investments with a quick deposit. It’s a great way to get an overview of how your money is performing.

Investment

| Initial lump sum*:£ | |

| Regular monthly contribution*: £ | |

| Expected rate of return - (e.g. 4.75): | |

| Number of saving years - (e.g. 15): | |