Anything is possible when you manage your money the right way. But it’s important to have realistic expectations of what your financial resources can achieve to enable you to reach your financial and lifestyle goals, without putting your future plans at risk. Key to this is understanding how each financial decision can affect other areas of your financial and lifestyle plans.

You also need to visualise that if there are any future bumps in the road on your journey, you’ve considered different ‘what if’ scenarios and have taken the right approach to protecting yourself and your family against the consequences.

Regular annual reviews of your personal plans and financial circumstances will also help you to adapt to your life changes and make you feel more financially secure and independent.

Lifestyle

Your financial plan should start with you – your hopes, fears, dreams, goals and vision for the future, incorporating both your current and future desired financial and lifestyle plans.

Return

Once you have a better understanding of your financial and lifestyle goals and what you want to achieve, together we can determine the required investment return in order to achieve your lifestyle goals.

Asset Allocation

Your required investment return will determine the asset allocation of your investment strategy, taking the associated investment risks into account.

Risk

It’s important to look at risk in the context of what you are trying to achieve, including how realistic your financial and lifestyle goals are based on your financial circumstances and what it is that you are trying to achieve.

We’ll spend time understanding your risk profile in detail – this is not limited to investment risk, but also includes inflation risk and behavioural risk.

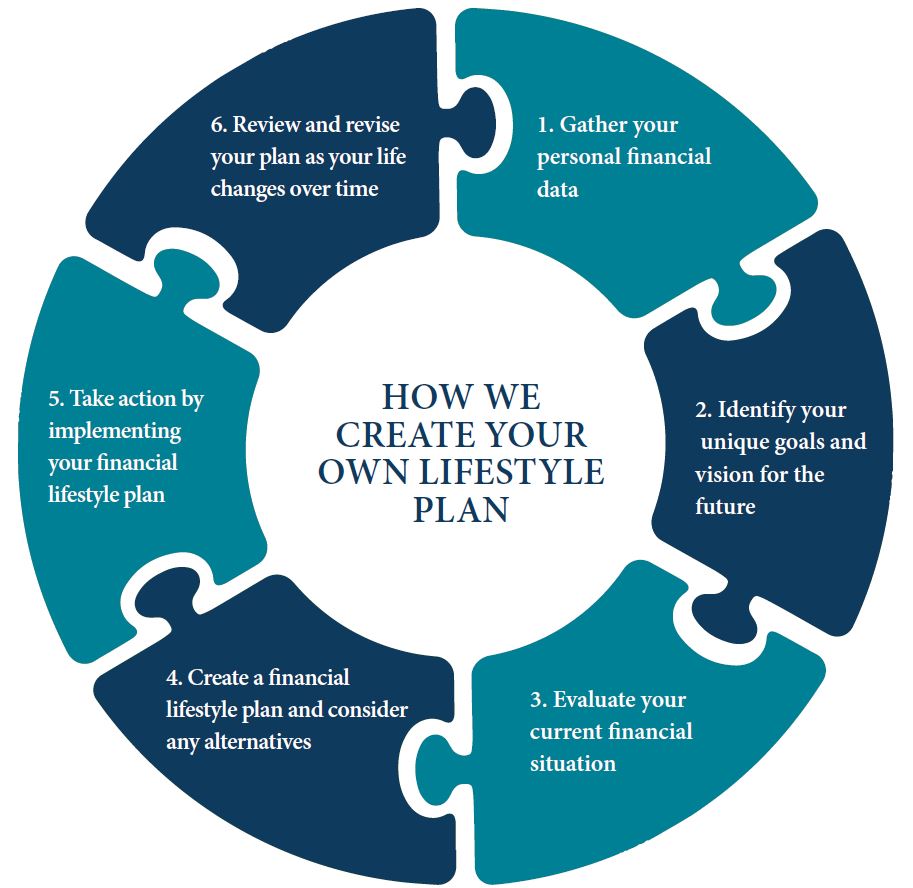

How we create your own lifestyle plan?

- Gather your personal financial data

- Identify your unique goals and vision for the future

- Evaluate your current financial situation

- Create a financial lifestyle plan and consider any alternatives

- Take action by implementing your financial lifestyle plan

- Review and revise your plan as your life changes over time

Get started today and contact one of our independent financial advisers here.

Follow us